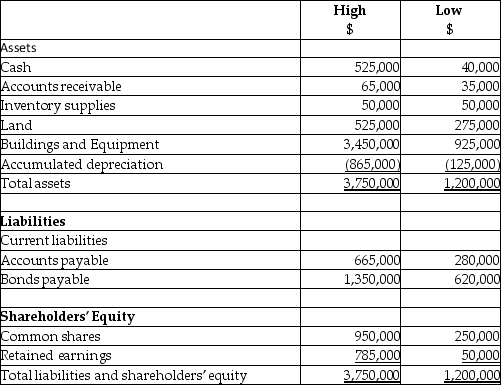

On September 1,20X5,High Limited decided to buy 70% of the shares outstanding of Low Inc.for $630,000.High will pay for this acquisition by using cash of $500,000 and issuing share capital for the remaining amount.The balances showing on the statement of financial position for the two companies at August 31,20X5 are as follows:

After a review of the financial assets and liabilities,High determines that some of the assets of Low have fair values different from their carrying values.These items are listed below:

• Land has a fair value of 225,000

• The building has a fair value of 1,090,000.The remaining useful life of the building is 20 years.

• Patent is $100,000.The patent is estimated to have a useful life of 5 years.

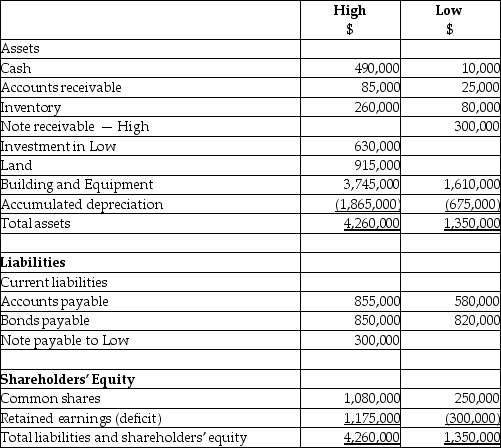

During the 20X7 fiscal year,the following events occurred:

1.On March 1,20X7,Low sold land to High for $390,000,which had a carrying value of $275,000.High paid for this with $90,000 cash and a note payable for the difference.This note pays interest at 10% which is paid monthly.

2.High sold supplies (included in High sales)to Low for $200,000.Profit margin on these sales is 25%.Low still has supplies on hand of $70,000.

3.In 20X6,Low had provided seat space on flights to High for a value of $500,000.This amount was included in sales for Low.Profit margin on these sales is 40%.At the end of August,20X6,High still had an amount of $200,000 in these prepaid seats that had not yet been used.(High includes this in inventory. )

Statements of Financial Position

As at August 31,20X7

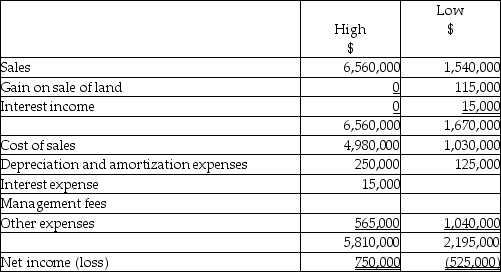

Statements of Comprehensive Income

For the year ended August 31,20X7

Required:

Calculate the balances for the following consolidated balances of High at August 31,20X7 assuming High uses the parent-company extension method approach:

a.Goodwill

b.Retained Earnings

c.Patent,net

Definitions:

Debt-Equity Ratio

A measure of a company's financial leverage calculated by dividing its total liabilities by shareholder equity.

Return On Assets

A measure of how effectively a company uses its assets to generate profit, calculated as net income divided by total assets.

Return On Equity

A measure of the profitability of a business in relation to the equity, calculated by dividing net income by shareholders' equity.

Profit Margin

A financial metric used to assess a company's profitability by comparing net income to sales. It's often expressed as a percentage indicating how much of each dollar in sales a company keeps as profit.

Q3: Which of the following statements about a

Q16: In Canada and the United States,at a

Q18: Waite Co.is a subsidiary of Star Ltd.During

Q30: If a foreign currency is strengthening with

Q34: organization that focuses its efforts on: (1)continuously

Q64: When a long-term note payable that requires

Q99: Art Parrish,the sole employee of Parrish Sales,has

Q131: Using the present value tables,please compute the

Q143: idea that individuals and organizations are accountable

Q251: Social responsibility is<br>A) the view that organizations