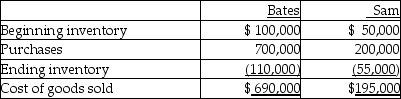

Bates Ltd.owns 60% of the outstanding common shares of Sam Ltd.During 20X6,sales from Sam to Bates were $200,000.Merchandise was priced to provide Sam with a gross margin of 20%.Bates' inventories contained $40,000 at December 31,20X5 and $15,000 at December 31,20X6 of merchandise purchased from Sam.Cost of goods sold for Bates and Sam for 20X6 on their separate-entity income statements were as follows:

What is the non-controlling interest's share of the consolidation adjustments on the income statement for the year ended December 31,20X6?

Definitions:

Interview Sessions

Structured interactions or meetings where questions are asked to gather information, opinions, or assess qualifications and characteristics of the interviewee.

Dramatic Body Language

The use of exaggerated movements or gestures to convey emotions or intentions.

Histrionic Personality Disorder

A psychological disorder characterized by a pattern of excessive emotionality and attention-seeking behavior.

Emotional Pain

A deeply distressing or disturbing experience of suffering related to psychological, not physical, causes.

Q2: Under the current-rate method,at what exchange rate

Q15: On November 2,20X9,Henry Company purchased a machine

Q18: Both Canada and Japan have adopted IFRS

Q32: A company has chosen accounting policies that

Q38: Exchange gains and losses on accounts receivable/payable

Q40: IQ has a wholly owned subsidiary in

Q104: McDonald Sales prepared a bond issue of

Q136: marketing mix elements are called _ because

Q152: FUTA (federal unemployment compensation)tax is paid by

Q243: idea that an organization should (1)strive to