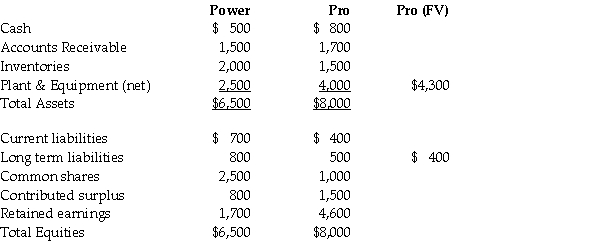

On December 31,20X6,the balance sheets of the Power Company and the Pro Company are as follows (amounts in thousands):

Power Company has 100,000 shares of common stock outstanding: Pro Company has 45,000 shares outstanding.All assets and liabilities have book value equal to fair values,except as noted.

The plant and equipment has an estimated remaining useful life of nine years from the date of acquisition.The long term liabilities mature on December 31,2010.Market value of the new shares issued was $90 per share at issuance.

Required:

Assume that 80% of the outstanding shares of Pro were acquired for cash of $5.8 million.Calculate goodwill and the non-controlling interest on the consolidated balance sheet at December 31,20X6 under the entity method and the parent-company extension method.

At December 31,20X9,the balance in the long term liabilities of Pro is still $500,000 and the balance of log term liabilities for Power is $900,000.Calculate the balance in the consolidated Long-term liabilities balance as at December 21,20X9.

Definitions:

Reciprocal Interdependence

A situation in a relationship where each party is mutually dependent on the other.

Adjourning

The final stage in group development when the group completes its task and disbands.

Bruce Tuckman

A psychologist who developed a model of group development stages, including forming, storming, norming, performing, and adjourning.

Group Development

The process through which a group evolves over time, typically through forming, storming, norming, performing, and adjourning stages.

Q1: What is often the main motivation behind

Q2: Yang Ltd.will issue interim financial statements for

Q18: What gives rise to accounting exposure to

Q20: Nashman Ltd.is a private enterprise with five

Q22: On October 15,2013,Rural Sales has a

Q45: A university needs to know the cost

Q59: The market rate is the rate used

Q70: good,service,or idea consisting of a bundle of

Q81: On January 1,2014,Partridge Company issued $50,000 of

Q104: Notes payable are considered short-term if they