On December 31,20X2,the Pipe Ltd.purchased 100% of the outstanding common shares of the Fitter Ltd.for $10.5 million in cash.On that date,the shareholders' equity of Fitter totaled $8 million and consisted of $1 million in no par common shares and $7 million in retained earnings.Both companies use the straight-line method to calculate depreciation and amortization.Goodwill,if any arises as a result of this business combination,is written down if there is a permanent impairment in its value.

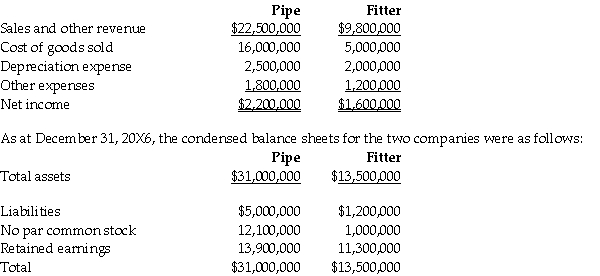

For the year ending December 31,20X6,the income statements for Pipe and Fitter were as follows:

OTHER INFORMATION:

1.On December 31,20X2,Fitter had a building with a fair value that was $500,000 greater than its carrying value.The building had an estimated remaining useful life of 20 years.

2.On December 31,20X2,Fitter had trademark that was not reported on its balance sheet,but had a fair value that was $200,000.The trademark is amortized over 10 years.

3.During 20X6,Fitter sold merchandise to Pipe for $100,000,a price that includes a gross profit of $40,000.During 20X6,20% of this merchandise was resold by Pipe and the other 80% remains in its December 31,20X6 inventories.On December 31,20X5,the inventories of Pipe contained merchandise purchased from Fitter on which Fitter had recognized a gross profit in the amount of $50,000.

4.During 20X6,it was determined that the goodwill arising at the date of acquisition was impaired and that an impairment loss of $70,000 should be recorded.No impairment had been charged in earlier years.

5.During 20X6,Pipe declared and paid dividends of $300,000 while Fitter declared and paid dividends of $100,000.

6.Pipe accounts for its investment in Fitter using the cost method.

The retained earnings of Pipe as at December 31,20X5 equalled $12,000,000.On that date,Fitter had retained earnings of $9,800,000.Fitter has not issued any common stock since its acquisition by Pipe.

Required:

Calculate the consolidated retained earnings at December 31,20X5 and December 31,20X6.Prepare the consolidated statement of changes equity-partial statement showing the change in retained earnings for December 31,20X6 for Pipe.

Definitions:

Variable Costs

Costs that vary directly with the level of production or service provision, such as materials and labor.

Output

The quantity of goods or services produced by a firm or industry.

Total Variable Costs

The sum of expenses that change in proportion to the activity of a business, such as costs for raw materials and labor, which vary with production volume.

Firm Produces

The process by which a business combines inputs, such as labor and capital, to create outputs, or goods and services, for consumption.

Q1: Under IFRS,which of the following statements is

Q4: The time value of money is based

Q10: On March 1,2012,Archer Sales purchases inventory

Q12: Paris Company buys a building on

Q22: An accrued expense is an expense that

Q30: Which of the following is not a

Q37: Which of the following are combined to

Q121: Art Parrish,the sole employee of Parrish Sales,has

Q125: SUTA (state unemployment compensation)tax is paid by

Q145: When a bond is sold,the selling price