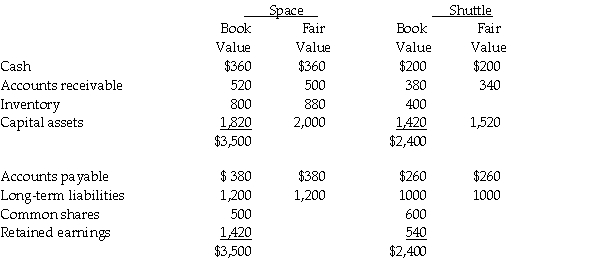

On December 31,20X5,Space Co.purchased 100% of the outstanding common shares of Shuttle Ltd.for $1,200,000 in shares and $200,000 in cash.The statements of financial position of Space and Shuttle immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

The difference in the carrying value and the fair value of the capital assets for Shuttle relates to its office building.This building was originally purchased by Shuttle in January,20X1 and is being depreciated over 30 years.

During 20X6,the year following the acquisition,the following occurred:

1.Shuttle borrowed $350,000 from Space on June 1,20X6,and was charged interest at 10% per annum,which it paid on a monthly basis.There were no repayments of principal made during the remaining of the year.

2.Throughout the year,Shuttle purchased merchandise of $800,000 from Space.Space's gross margin is 30% of selling price.At December 31,20X6,Shuttle still owed Space $250,000 on this merchandise.75% of this merchandise was resold by Shuttle prior to December 31,20X6.

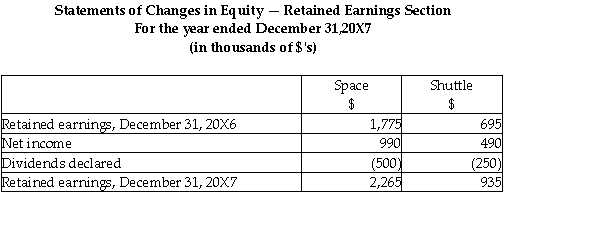

3.Shuttle paid dividends of $250,000 at the end of 20X6 and Space paid dividends of $500,000.

During 20X7,the following occurred:

1.Shuttle paid $150,000 on the loan payable to Space on May 30,20X7.

2.Throughout the year,Shuttle purchased merchandise of $1,000,000 from Space.Space's gross margin is 30% of selling price.At December 31,20X6,Shuttle still owed Space $150,000 on this merchandise.85% of this merchandise was resold by Shuttle prior to December 31,20X7.

3.Shuttle paid dividends of $250,000 at the end of 20X7 and Space paid dividends of $500,000.

Required:

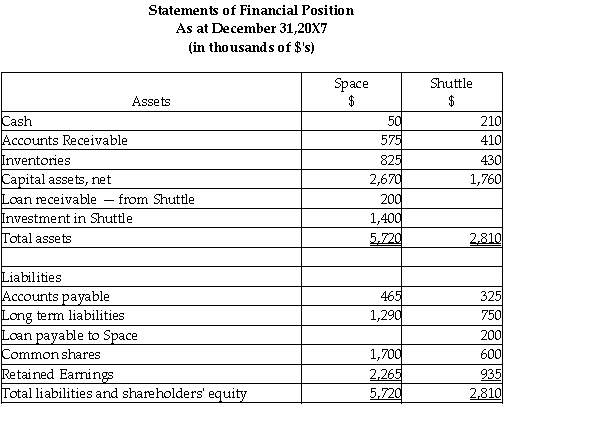

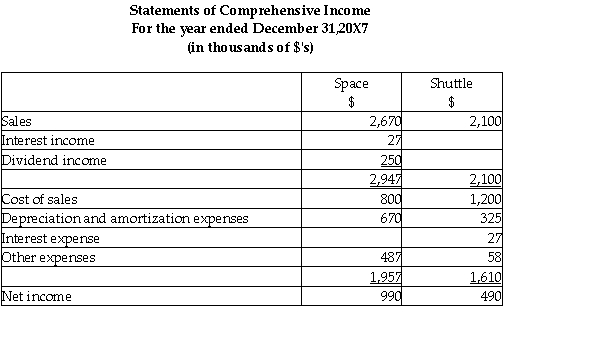

Space has decided to record its investment in Shuttle using the equity method.Determine the balance in the investment in Shuttle account at December 31,20X7 using the equity method.

Prepare the statement of financial position and the statement of comprehensive income for the year ended December 31,20X7 for Space assuming it accounts for its investment in Shuttle using the equity method.

Definitions:

External Price

External price refers to the price of a product or service determined by market conditions outside of a company or organization, influencing or reflecting its value in the broader market.

Nonfinancial Information

Data regarding a company's operations, strategies, risks, and opportunities that is not quantifiable in monetary terms.

Alternative Courses

Different options or paths that can be taken in decision-making situations, often evaluated for potential outcomes.

Unprofitable Product Line

A series of related products that do not generate expected profits, often identified through financial analysis for potential discontinuation.

Q1: A contingent liability that will probably become

Q2: On December 31,2013,what will the balance be

Q20: HB Company is a private company with

Q24: What is the most common valuation method

Q80: Booker Company reported sales revenue for 2013

Q108: The Statewide Sales Company has gross

Q123: respect to the history of American business,the

Q134: Art Parrish is the sole employee of

Q145: is the abridged American Marketing Association definition

Q151: The balance in the Bonds payable account