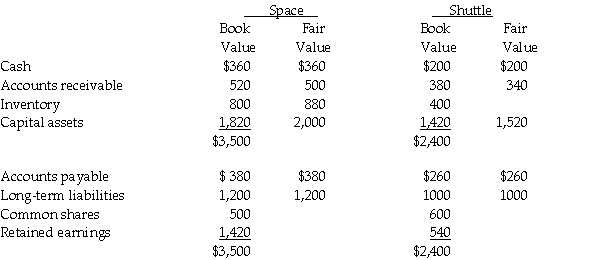

On December 31,20X5,Space Co.purchased 100% of the outstanding common shares of Shuttle Ltd.for $1,200,000 in shares and $200,000 in cash.The statements of financial position of Space and Shuttle immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

The difference in the carrying value and the fair value of the capital assets for Shuttle relates to its office building.This building was originally purchased by Shuttle in January,20X1 and is being depreciated over 30 years.

During 20X6,the year following the acquisition,the following occurred:

1.Shuttle borrowed $350,000 from Space on June 1,20X6,and was charged interest at 10% per annum,which it paid on a monthly basis.There were no repayments of principal made during the remaining of the year.

2.Throughout the year,Shuttle purchased merchandise of $800,000 from Space.Space's gross margin is 30% of selling price.At December 31,20X6,Shuttle still owed Space $250,000 on this merchandise.75% of this merchandise was resold by Shuttle prior to December 31,20X6.

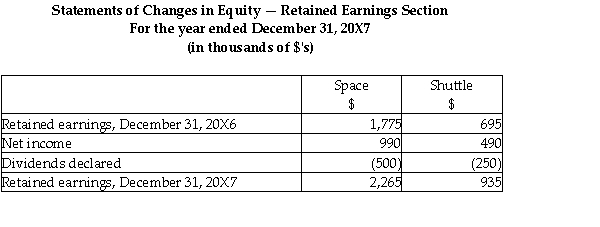

3.Shuttle paid dividends of $250,000 at the end of 20X6 and Space paid dividends of $500,000.

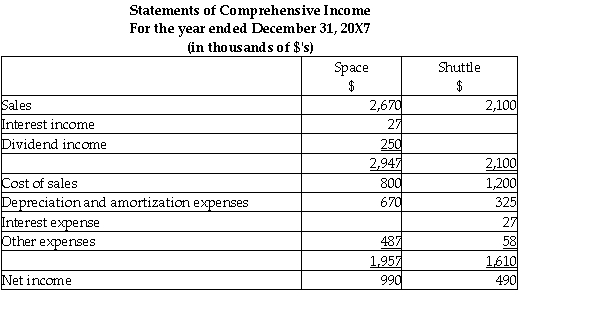

During 20X7,the following occurred:

1.Shuttle paid $150,000 on the loan payable to Space on May 30,20X7.

2.Throughout the year,Shuttle purchased merchandise of $1,000,000 from Space.Space's gross margin is 30% of selling price.At December 31,20X6,Shuttle still owed Space $150,000 on this merchandise.85% of this merchandise was resold by Shuttle prior to December 31,20X7.

3.Shuttle paid dividends of $250,000 at the end of 20X7 and Space paid dividends of $500,000.

Required:

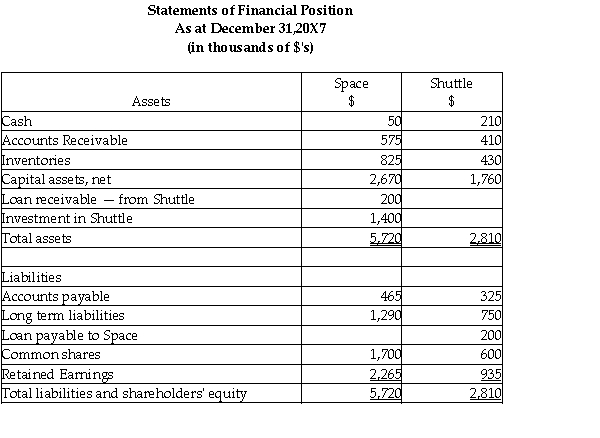

Calculate the consolidated retained earnings for Space as at December 31,20X7.

Prepare the consolidated statement of financial position for the year ended December 31,20X7 for Space.

Definitions:

Net Income

The concluding income of a company after removing the costs and taxes from its revenue.

Average Total Assets

The mean value of all the assets a company owns, calculated by adding the beginning and ending total asset balances during a period and dividing by two.

Earnings Activities

Activities that generate income for a business, including operations, sales, and investments.

Revenues

The overall sum of money a company earns from selling products or delivering services over a specific time frame.

Q1: Proudfoot Ltd.acquired all the shares of Jacob

Q2: Which of the following is not a

Q13: Slade Co.has 1,000,000 shares outstanding and is

Q19: Private companies in Canada may follow either

Q19: Which of the following accounting methods is

Q24: Mitzy's Muffins Ltd.purchased a commercial baking system

Q39: On May 1,2014,Metro Company has bonds

Q125: SUTA (state unemployment compensation)tax is paid by

Q213: place strategy made it convenient for _

Q257: period of American business history when firms