On December 31,20X1,the Dad Ltd.purchased 100% of the outstanding common shares of the Sad Ltd.for $9.5 million in cash.On that date,the shareholders' equity of Sad totaled $8 million and consisted of $1 million in no par common shares and $7 million in retained earnings.Both companies use the straight-line method to calculate depreciation.Goodwill,if any arises as a result of this business combination,is written down if there is a permanent impairment in its value.

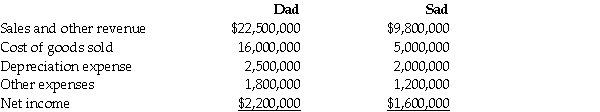

For the year ending December 31,20X6,the statements of comprehensive income for Dad and Sad were as follows:

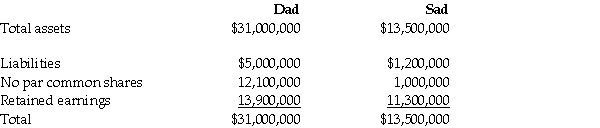

As at December 31,20X6,the condensed statements of financial position for the two companies were as follows:

OTHER INFORMATION:

1.On December 31,20X1,Sad had a building with a fair value that was $300,000 greater than its carrying value.The building had an estimated remaining useful life of 20 years.

2.On December 31,20X1,Sad had inventory with a fair value that was $200,000 less than its carrying value.This inventory was sold in 20X3.

3.During 20X6,Dad sold merchandise to Sad for $100,000,a price that includes a gross profit of $40,000.During 20X6,40% of this merchandise was resold by Sad to third parties and the other 60% remains in its December 31,20X6 inventories.On December 31,20X5,the inventories of Sad contained merchandise purchased from Dad on which Dad had recognized a gross profit in the amount of $20,000.

4.During 20X6,Dad declared and paid dividends of $300,000 while Sad declared and paid dividends of $100,000.

5.Dad accounts for its investment in Sad using the cost method.

6.The retained earnings of Dad as at December 31,20x5 was $12,000,000.On that date,Sad had retained earnings of $9,800,000.Sad has not issued any common shares since its acquisition by Dad.

7.There were no specific events or circumstances between 20X2 and 20X6 to indicate any impairment of goodwill.

The retained earnings of Dad as at December 31,20X5 equalled $12,000,000.On that date,Sad had retained earnings of $9,800,000.Sad has not issued any common shares since its acquisition by Dad.

Required:

Calculate the consolidated retained earnings at December 31,20X6.

Definitions:

Whitewater Rafting

A recreational outdoor activity which uses an inflatable raft to navigate through rough or whitewater rivers.

Producer Surplus

The difference between the amount a producer is willing to accept for a good or service and the actual amount received from selling it at the market price.

Cupcakes

Small, individually-sized cakes that are typically frosted and decorated, often used to celebrate events or milestones.

Total Surplus

Total surplus is the sum of consumer surplus and producer surplus in a market, representing the total benefits to both buyers and sellers from trade.

Q4: Foster Ltd.acquired 100% of Benson Ltd.The carrying

Q9: Ace Appliances sells dishwashers with a 3-year

Q10: Forest Ltd.reports its investment in Leeds Co.on

Q24: Mitzy's Muffins Ltd.purchased a commercial baking system

Q30: On September 1,20X5,CanAir Limited decided to buy

Q36: Portia Ltd.acquired 80% of Siro Ltd.on December

Q43: If a company issues a bond in-between

Q43: Good internal controls over payroll would include

Q46: Which of the following is an important

Q129: Art Parrish,the sole employee of Parrish Sales,has