On December 31,20X2,the Pipe Ltd.purchased 100% of the outstanding common shares of the Fitter Ltd.for $10.5 million in cash.On that date,the shareholders' equity of Fitter totaled $8 million and consisted of $1 million in no par common shares and $7 million in retained earnings.Both companies use the straight-line method to calculate depreciation and amortization.Goodwill,if any arises as a result of this business combination,is written down if there is a permanent impairment in its value.

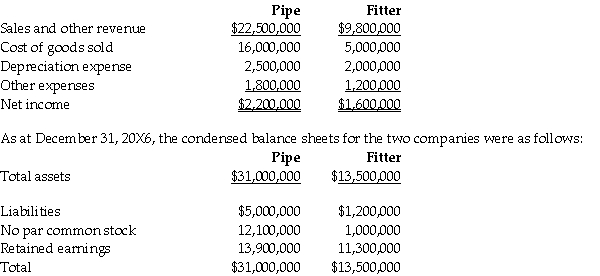

For the year ending December 31,20X6,the income statements for Pipe and Fitter were as follows:

OTHER INFORMATION:

1.On December 31,20X2,Fitter had a building with a fair value that was $500,000 greater than its carrying value.The building had an estimated remaining useful life of 20 years.

2.On December 31,20X2,Fitter had trademark that was not reported on its balance sheet,but had a fair value that was $200,000.The trademark is amortized over 10 years.

3.During 20X6,Fitter sold merchandise to Pipe for $100,000,a price that includes a gross profit of $40,000.During 20X6,20% of this merchandise was resold by Pipe and the other 80% remains in its December 31,20X6 inventories.On December 31,20X5,the inventories of Pipe contained merchandise purchased from Fitter on which Fitter had recognized a gross profit in the amount of $50,000.

4.During 20X6,it was determined that the goodwill arising at the date of acquisition was impaired and that an impairment loss of $70,000 should be recorded.No impairment had been charged in earlier years.

5.During 20X6,Pipe declared and paid dividends of $300,000 while Fitter declared and paid dividends of $100,000.

6.Pipe accounts for its investment in Fitter using the cost method.

The retained earnings of Pipe as at December 31,20X5 equalled $12,000,000.On that date,Fitter had retained earnings of $9,800,000.Fitter has not issued any common stock since its acquisition by Pipe.

Required:

Calculate the consolidated retained earnings at December 31,20X5 and December 31,20X6.Prepare the consolidated statement of changes equity-partial statement showing the change in retained earnings for December 31,20X6 for Pipe.

Definitions:

Seed Dispersal

The mechanism by which seeds are spread away from their parent plant, reducing competition and aiding species spread.

Sexual Reproduction

A biological process by which organisms create offspring by combining genetic material from two different sexes.

Flowering

The process by which plants produce flowers, which are the reproductive structures that facilitate sexual reproduction involving pollination and seed production.

Dormancy

In plants, a cessation of growth under conditions that seem appropriate for growth.

Q1: When a subsidiary issues shares,_.<br>A)no gain or

Q2: Which element of the marketing mix is

Q8: On the consolidated statement of financial position,which

Q11: Devon Ltd.acquired 90% of Luka Ltd.for $100,000

Q18: On January 1,2013,Diab Services issued $140,000 of

Q20: In consolidating parent-founded subsidiaries,what account is used

Q48: Helvetia Corp. ,a Swiss firm,bought merchandise from

Q77: A bond payable is similar to which

Q81: Which of the following deductions must be

Q135: Art Parrish is the sole employee of