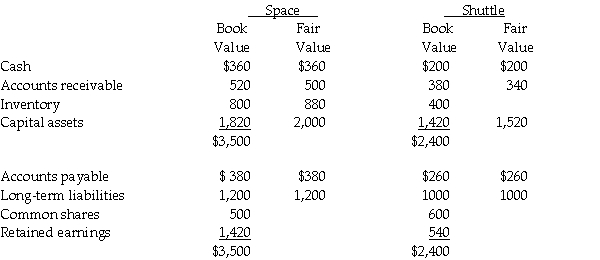

On December 31,20X5,Space Co.purchased 100% of the outstanding common shares of Shuttle Ltd.for $1,200,000 in shares and $200,000 in cash.The statements of financial position of Space and Shuttle immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

The difference in the carrying value and the fair value of the capital assets for Shuttle relates to its office building.This building was originally purchased by Shuttle in January,20X1 and is being depreciated over 30 years.

During 20X6,the year following the acquisition,the following occurred:

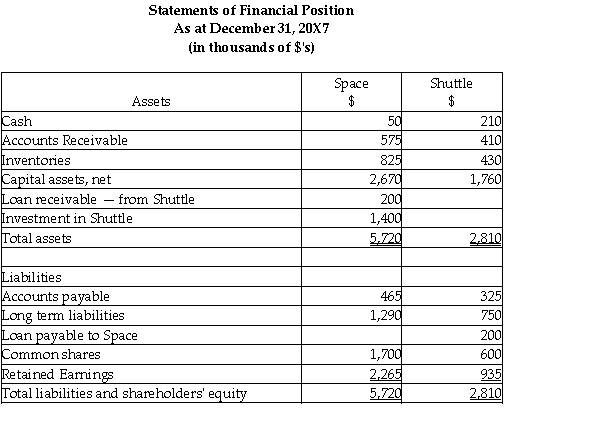

1.Shuttle borrowed $350,000 from Space on June 1,20X6,and was charged interest at 10% per annum,which it paid on a monthly basis.There were no repayments of principal made during the remaining of the year.

2.Throughout the year,Shuttle purchased merchandise of $800,000 from Space.Space's gross margin is 30% of selling price.At December 31,20X6,Shuttle still owed Space $250,000 on this merchandise.75% of this merchandise was resold by Shuttle prior to December 31,20X6.

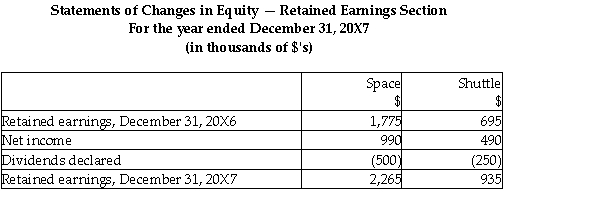

3.Shuttle paid dividends of $250,000 at the end of 20X6 and Space paid dividends of $500,000.

During 20X7,the following occurred:

1.Shuttle paid $150,000 on the loan payable to Space on May 30,20X7.

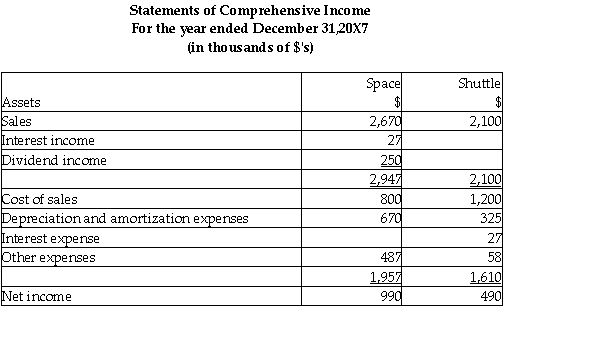

2.Throughout the year,Shuttle purchased merchandise of $1,000,000 from Space.Space's gross margin is 30% of selling price.At December 31,20X6,Shuttle still owed Space $150,000 on this merchandise.85% of this merchandise was resold by Shuttle prior to December 31,20X7.

3.Shuttle paid dividends of $250,000 at the end of 20X7 and Space paid dividends of $500,000.

Required:

Prepare the consolidated statement of comprehensive income for the year ended December 31,20X7 for Space.

Definitions:

Imperfect Competitor

A firm that has some control over the market price of its product because the product is differentiated and there are few substitutes.

Wage Rate

The amount of money paid to an employee per unit of time, often hourly or annually, for their labor.

Wage Rate

The amount of money paid to an employee for a specified quantity of work, usually expressed per hour or year.

Perfect Competitor

A theoretical market structure where many firms sell identical products, entry and exit are easy, and no single buyer or seller can influence the market price.

Q1: Sparrow Pension Plan is a not-for-profit organization

Q2: Morin Co.acquired all the shares of Lightfoot

Q4: Compare and contrast the goodwill impairment test

Q14: On March 1,20X2,McBride Ltd.issued a purchase order

Q16: Helvetia Corp. ,a Swiss firm,bought merchandise from

Q17: There is certain information that reportable segments

Q30: Unearned revenue is an obligation to provide

Q32: Which of the following is not a

Q105: Which of the following taxes does NOT

Q135: Organizational buyers are described as<br>A) only purchasers