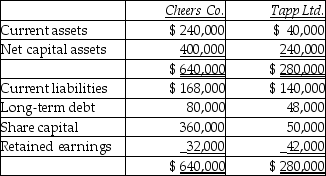

Cheers acquired 100% of Tapp's shares for $150,000.On the acquisition date,the fair value of the current assets and the net capital assets were $104,000 and $216,000 respectively.The fair value of the liabilities equalled their book value.On Cheers' consolidated statement of financial position,what is the total of its shareholders' equity?

Definitions:

Total Cost

The sum of all costs associated with producing or acquiring an item or service, including direct and indirect expenses.

Contribution Margin

The difference between sales revenue and variable costs, indicating how much revenue contributes to fixed costs and profit.

Sales Volume

The quantity of products or services sold by a business within a specific period.

Contribution Margin

The difference between sales revenue and variable costs, representing the portion of sales revenue that contributes to covering fixed costs and generating profit.

Q4: If a note payable has installments due

Q8: Sya Ltd.acquired all the assets and liabilities

Q21: Which of the following statements about IFRS

Q22: What does the net debt indicate on

Q29: Which financial reporting approach has Canada decided

Q37: Which of the following organizations does IFRS

Q60: Carter Company records sales on account of

Q122: Innovators at 3M developed Scotch-Brite<sup>®</sup> Never Rust

Q160: A company's accountant capitalizes a payment that

Q176: purpose of the introduction of 3M Post-it<sup>®</sup>