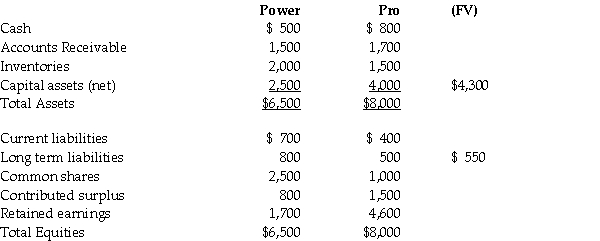

On December 31,20X6,the statements of financial position of the Power Company and the Pro Company are as follows: (in 000s)

Power Company has 100,000 shares of common stock outstanding.Pro Company has 45,000 shares outstanding.On January 1,20X7 Power issued an additional 90,000 shares of common stock in exchange for all the net assets of Pro.All assets and liabilities have book value equal to fair values,except as noted.In addition,Pro has a patent that has an appraised fair value of $450.

Market value of the new shares issued was $95 per share at the date of acquisition.

Required:

a.What is the amount of goodwill to be recorded for this business combination? Prepare the journal entry that Power would record on January 1,20X7 related to this acquisition.In this case,who are the shareholders and their percentage holdings on January 1,20X7? Prepare the statement of financial position for Power as at January 1,20X7.

b.How would your answer differ if Power had purchased the shares rather than the net assets of Pro Company? In this case,who are the shareholders and their percentage holdings on January 1,20X7?

Definitions:

Unamortized Bond Discount

The portion of a bond discount that has not yet been expensed to interest expense over the life of the bond.

Bonds

Fixed-income investment products that represent loans made by an investor to a borrower, typically corporate or governmental.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board (IASB) that serve as a global framework for the preparation of public company financial statements.

Premium Account

An upgraded account or service that a customer opts for, typically providing additional features or benefits for an extra cost.

Q2: Which of the following are pay amounts

Q6: In consolidating a wholly-owned parent-founded subsidiary,which of

Q7: In changing from the cost method to

Q21: On September 1,20X5,High Limited decided to buy

Q26: A parent company can record an investment

Q35: In Canada,what type of business combination can

Q45: On March 1,20X2,McBride Ltd.issued a purchase order

Q67: Tom's gross pay for the week is

Q80: Which of the following entries needs

Q139: Art Parrish,the sole employee of Parrish Sales,has