Sugar Corp and Syrup Limited have reached an agreement in principle to combine their operations as of October 1,20X9.However,the Board of directors cannot decide on the best way to accomplish the combination.Below are the alternatives being considered:

1.Sugar acquires the net assets of Syrup for $1,700,000 cash.

2.Sugar acquires only the assets for $2,650,000 cash.

3.Sugar acquires all of the outstanding shares of Syrup by issuing shares with a fair market value of $1,700,000.

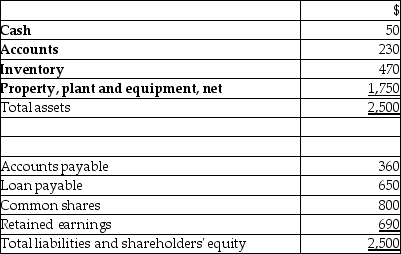

Syrup has the following assets and liabilities at October 1,20X9,(in thousands of dollars)

The only item that has a fair value different from its carrying value is the property,plant and equipment,which has a fair value of $1,900.

Required:

Explain how each transaction is different from the acquirer's point of view.Prepare the journal entry that would be recorded by Sugar for each these alternatives.

Definitions:

Field Experiment

A study conducted in a real-world setting where the researcher manipulates one or more variables to observe the effect on a particular outcome.

Independent Variable

The factor in an experiment that is intentionally changed to observe its effect on the dependent variable.

Role Models

are individuals admired for their behaviors, qualities, or achievements, who serve as examples for others to emulate.

Behavior Modeling

A training method that involves showing learners how to perform a behavior by acting it out, often used in skill acquisition.

Q10: According to the recommendations of the Public

Q25: Interest payable would normally be shown on

Q30: Which consolidation method does not include incorporating

Q46: Blanding Company issues $1,000,000 of 8%,10-year bonds

Q50: the future,3M will make use of _

Q68: Sue works 46 hours at her job

Q85: On October 1,2012,Archer Sales borrows $100,000

Q109: Hastings Company has purchased a group

Q138: Dan Jones and Pat Smith are the

Q139: Which of the following statements best describes