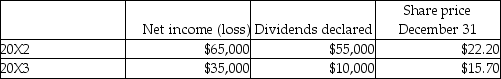

On January 1,20X2,Soho Co.purchased 4,000 shares,representing 12%,of Rico Inc.for $78,000.Soho is a publicly traded company.During the next two years,the following information was available for Rico.

Required:

a.Assuming Soho classifies this investment as FVTPL,prepare the journal entries for the next two years related to this investment,and the carrying value of the investment at the end of 20X2 and 20X3.

b.Assuming Soho classifies this investment as FVTOCI,prepare the journal entries for the next two years related to this investment,and the carrying value of the investment at the end of 20X2 and 20X3.

Definitions:

Mark-Up

An amount added to the cost price of goods to cover overhead and profit.

Impairment Loss

The amount by which the carrying amount of an asset or cash-generating unit exceeds its recoverable amount, necessitating a write-down.

Effective Tax Rate

The average rate at which an individual or corporation is taxed, calculated by dividing the total taxes paid by the taxable income.

Equity Method

An accounting technique used to record investments in other companies, where the investment's value is adjusted for profits, losses, and dividends.

Q1: Under the temporal method,at what exchange rate

Q6: Diaz Ltd.acquired 35% of Saturn Ltd.many years

Q13: LaSalle Ltd. ,a Canadian company has a

Q19: Under the temporal method,how is an exchange

Q21: What happens on July 1,2014?<br>A) Avery pays

Q32: On January 2,2014,Mahoney Sales issued $10,000 in

Q42: A local ice cream shop pledged 10%

Q47: Art Parrish,the sole employee of Parrish Sales,has

Q68: Sue works 46 hours at her job

Q117: David Windorski,an inventor at 3M,questioned dozens of