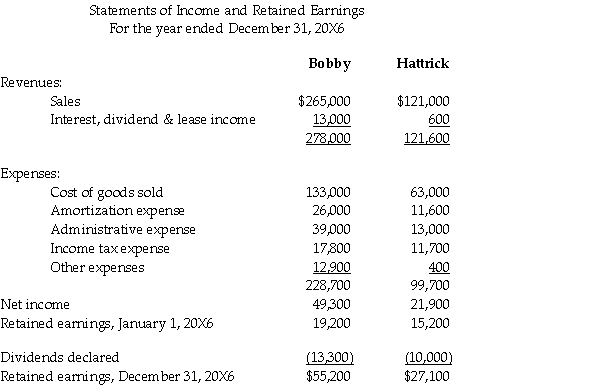

Hattrick Corp.is a wholly owned,parent-founded subsidiary of Bobby Inc.The unconsolidated statements of income and the statement of changes of retained earnings for the two companies for the year ended December 31,20X6,are as follows (in 000s):

Additional information:

• Bobby sells some of its output to Hattrick.During 20X6,intercompany sales amounted to $25,000,000.Hattrick has accounts payable owing to Bobby for $200,000 at December 31,20X6.

• Bobby owns the land on which Hattrick's building is located.Bobby leases the land to Hattrick for $30,000 per month.

Bobby accounts for its investment in Hattrick under the cost method

Assume that Bobby is a private corporation that reports under ASPE.Prepare the statement of income and retained earnings for Bobby for the year 20X6 using the equity method.

Definitions:

Q1: When is an obligation recorded under an

Q2: Mallard Ltd.acquired 75% of the outstanding common

Q5: When budgetary control accounts are first set

Q13: societal marketing concept<br>A) is the moral principles

Q20: Nashman Ltd.is a private enterprise with five

Q23: Bates Ltd.owns 60% of the outstanding common

Q35: are you,as a student,already somewhat of a

Q39: Which of the following items is a

Q80: Which of the following entries needs

Q116: Payroll tax expense includes the employer's portion