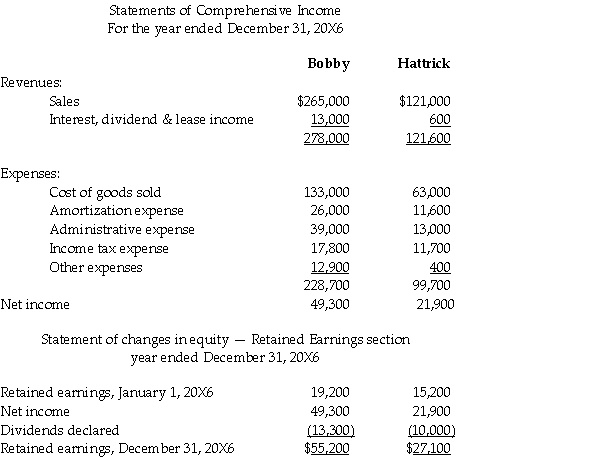

Hattrick Corp.is a wholly owned,parent-founded subsidiary of Bobby Inc.Both Bobby and Hattrick report under IFRS.The unconsolidated statements of comprehensive income and part of the statement of changes in equity-retained earnings for the two companies for the year ended December 31,20X6,are as follows (in 000s):

Additional information:

• Bobby sells some of its output to Hattrick.During 20X6,intercompany sales amounted to $25,000,000.Hattrick has accounts payable owing to Bobby for $200,000 at December 31,20X6.

• Bobby owns the land on which Hattrick's building is located.Bobby leases the land to Hattrick for $30,000 per month.

• Bobby accounts for its investment in Hattrick under the cost method.

Required:

Prepare a consolidated statement of comprehensive income and consolidated statement of changes in equity - retained earnings section for Bobby Inc.for the year ended December 31,20X6.

Definitions:

Mode

describes the value that appears most frequently in a data set.

Mean

A statistical measure that represents the average value of a set of numbers.

Range

in statistics, is the difference between the highest and lowest values in a data set.

Corpus Callosum

The thick bundle of nerve fibers that connects the left and right hemispheres of the brain.

Q22: Which of the following user groups has

Q26: High Traders Inc.is a private Canadian company.The

Q26: Sya Ltd.acquired all the assets and liabilities

Q69: Associated Foods had cash sales of

Q90: Art Parrish,the sole employee of Parrish Sales,has

Q94: China,many people are removing their money from

Q98: Which of the following is included in

Q114: A mortgage payable is a debt that

Q137: If the difference between the effective-interest method

Q221: Figure 1-5 above,letter "C" represents which era