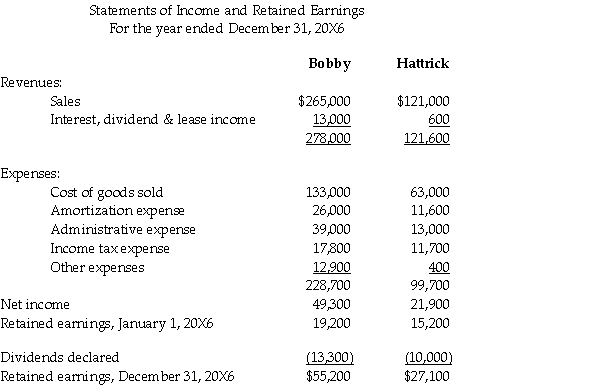

Hattrick Corp.is a wholly owned,parent-founded subsidiary of Bobby Inc.The unconsolidated statements of income and the statement of changes of retained earnings for the two companies for the year ended December 31,20X6,are as follows (in 000s):

Additional information:

• Bobby sells some of its output to Hattrick.During 20X6,intercompany sales amounted to $25,000,000.Hattrick has accounts payable owing to Bobby for $200,000 at December 31,20X6.

• Bobby owns the land on which Hattrick's building is located.Bobby leases the land to Hattrick for $30,000 per month.

Bobby accounts for its investment in Hattrick under the cost method

Assume that Bobby is a private corporation that reports under ASPE.Prepare the statement of income and retained earnings for Bobby for the year 20X6 using the equity method.

Definitions:

Icon Sets

A collection of symbols or icons that visually represent various statuses or categories in a software application.

Conditional Formats

Conditional formats refer to Excel features that allow users to automatically apply formatting options, such as font or background color, to cells that meet certain criteria.

Header And Footer Tools Design Tab

A feature in word processing applications that allows the user to insert and customize headers and footers in a document.

Footer Text Box

A designated area at the bottom of a document or slide where additional information such as page number, date, or copyright notice can be entered.

Q1: Sparrow Pension Plan is a not-for-profit organization

Q8: On the consolidated statement of financial position,which

Q10: On March 1,2012,Archer Sales purchases inventory

Q17: value to consumers that comes from making

Q23: The time value of money is based

Q43: On March 1,20X2,McBride Ltd.issued a purchase order

Q44: On November 1,2015,Archangel Services issued $200,000 of

Q48: A plant asset is sold for $1,000.The

Q58: Archie's had sales of $6,758.The state sales

Q76: An asset costs $80,000 and has a