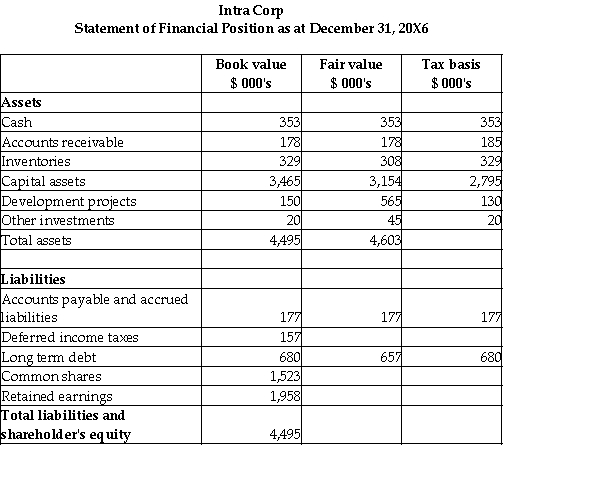

On January 1,20X7,Falcon acquired 100% of the outstanding shares of Intra for $3,600,000.Both are mining companies involved in nickel and copper production.The balance sheet for Intra at the date of acquisition is shown below together with estimated of the fair values and tax values of Intra's recorded assets and liabilities.

The tax rate for Intra and for Falcon is 30%.

Required:

What is the amount of goodwill to be recorded for this business combination?

Definitions:

Average Cost

The per-unit cost obtained by dividing total production expenses by the number of produced units.

Patent Policies

Regulations and guidelines governing the protection of inventions and intellectual property to encourage innovation and investment in research and development.

Electronics

Devices or systems that operate using the flow and control of electrons in semiconductors, vacuum tubes, or other components.

Computers

Electronic devices capable of executing programmed instructions for processing data, performing calculations, and managing information.

Q1: Compare and contrast accounting for foreign currency

Q3: Cooper Ltd.acquired 70% of the common shares

Q6: Which of the following is a financial

Q15: The recommendation for interim income tax expense

Q17: Which of the following statements is true?<br>A)The

Q28: On January 1,20X3,Dwayne Ltd.formed Carlos Co. ,a

Q32: Thad Ltd.acquired 100% of the common shares

Q33: The thresholds for segmental financial reporting exclude

Q41: A bond is sold for an amount

Q125: Explain what is meant by the concept