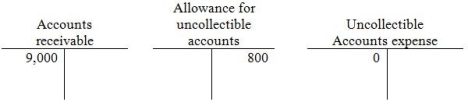

At January 1,Davidson Services has the following balances:  During the year,Davidson has $104,000 of credit sales,collections of $100,000,and write-offs of $1,400. Davidson records Uncollectible accounts expense at the end of the year using the percent-of-sales method,and applies a rate of 1.1%,based on past history.

During the year,Davidson has $104,000 of credit sales,collections of $100,000,and write-offs of $1,400. Davidson records Uncollectible accounts expense at the end of the year using the percent-of-sales method,and applies a rate of 1.1%,based on past history.

Prior to the year-end entry to adjust the Uncollectible accounts expense,what is the balance in Accounts receivable?

Definitions:

Perpetual Inventory System

The perpetual inventory system is a method of accounting for inventory that records sales and purchases instantly through computer systems, maintaining continuous balance updates.

LIFO

LIFO (Last In, First Out) is an inventory valuation method where the most recently produced or acquired items are the first to be expensed.

Cost of Goods Sold

Expenses directly related to manufacturing the products a company sells, involving costs of materials and labor.

Perpetual Inventory System

An inventory management system that keeps continuous, real-time records of goods as they are received and sold.

Q11: What is a purchase return?<br>A) A return

Q16: Which of the following correctly describes Interest

Q22: The cash balance in a company's general

Q85: Which of the following statements describes an

Q94: On January 1,2013,Davie Services issued $20,000 of

Q107: Which of the following statements is TRUE

Q139: <br>Prior to the year-end entry to adjust

Q139: How much gain or loss is reported

Q139: Under periodic inventory,the company first calculates Cost

Q160: Which of the following describes the control