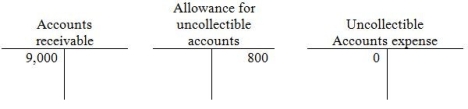

At January 1,Davidson Services has the following balances:  During the year,Davidson has $104,000 of credit sales,collections of $100,000,and write-offs of $1,400. Davidson records Uncollectible account expense at the end of the year using the percent-of-sales method,and applies a rate of 1.1%,based on past history.

During the year,Davidson has $104,000 of credit sales,collections of $100,000,and write-offs of $1,400. Davidson records Uncollectible account expense at the end of the year using the percent-of-sales method,and applies a rate of 1.1%,based on past history.

-

After the year-end entry to adjust the Uncollectible accounts expense,what is the ending balance in the Allowance for uncollectible accounts?

Definitions:

Cash Dividends

Cash payouts by a company to its stock owners, regularly as a sharing of profits.

Net Income

The amount of profit left after all expenses, taxes, and costs have been subtracted from total revenue.

Stockholders' Equity

The residual interest in the assets of a corporation after deducting its liabilities, often referred to as shareholders' equity.

Common Stock Dividends Distributable

A liability account representing the amount of dividends declared by a company's board of directors but not yet paid to common shareholders.

Q20: Avery Sales purchased telecom equipment for $12,000

Q31: On December 1,2014,Parsons Sales sold machinery to

Q65: FUTA (federal unemployment compensation)tax is paid by

Q66: A petty cash fund was established

Q66: On January 1,2013,Davie Services issued $20,000

Q85: A company purchased 100 units for $20

Q100: Companies that use GAAP accounting will prefer

Q114: What is depreciation expense for 2013

Q114: Face value of a note payable plus

Q130: A $20,000,3-month,8% note payable was issued on