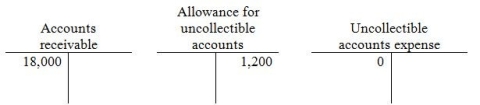

At January 1,Everbright Sales has the following balances:  During the year,Everbright has $150,000 of credit sales,collections of $140,000,and write-offs of $3,000.Everbright records Uncollectible accounts expense at the end of the year using the aging method.At the end of the year,the aging analysis produces a figure of $1,900,being the estimate of uncollectible accounts at end of year.

During the year,Everbright has $150,000 of credit sales,collections of $140,000,and write-offs of $3,000.Everbright records Uncollectible accounts expense at the end of the year using the aging method.At the end of the year,the aging analysis produces a figure of $1,900,being the estimate of uncollectible accounts at end of year.

-Before the year-end entry to adjust the Uncollectible accounts expense is made,what is the balance in the Uncollectible accounts expense?

Definitions:

Owner Relationship

The legal and operational connections and responsibilities between the owner(s) and their business entity.

Short-Term Investments

Investments that are typically held for one year or less, intended for quick gains or temporary cash investment.

Sinking Funds

A type of savings account or fund that is set up to repay debt or an outstanding loan, making periodic payments into the fund for this purpose.

Operating Cycle

The duration of time it takes for a company to purchase inventory, sell the products, and collect cash from the sales.

Q10: What would the Cost of goods

Q16: What will be the amount of Uncollectible

Q16: A petty cash fund was established

Q17: FICA tax is a tax which is

Q19: Which of the following describes a secured

Q25: Interest payable would normally be shown on

Q118: On November 1,2013,Archangel Services issued $200,000

Q126: When a company ships goods to a

Q159: Under the Sarbanes-Oxley Act,accounting firms are prohibited

Q164: The cost of land includes the cost