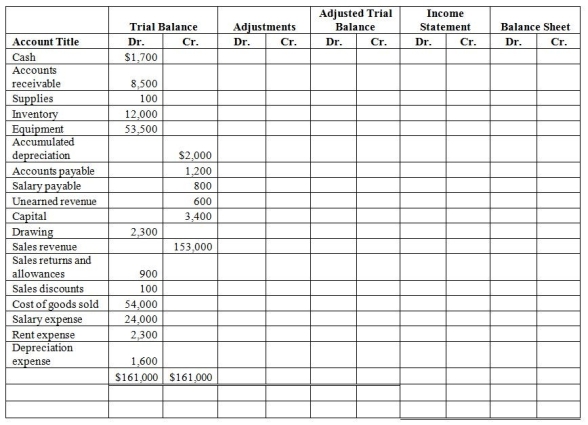

Baltic Supplies provides the worksheet shown below at the end of the year.

A count of the physical inventory at year end shows that there is actually $11,000 of inventory left.Assuming this is the only adjusting entry needed at year-end,please post the inventory adjustment to the worksheet and update the adjusted trial balance.Then complete the worksheet.

Definitions:

Revenues

The total amount of income generated by the sale of goods or services related to the company's primary operations.

Profits

Financial gains obtained when the revenue from business activities exceeds the expenses, taxes, and costs of operating.

Temporary Difference

A discrepancy between the carrying amount of an asset or liability in the balance sheet and its tax base, creating taxable or deductible amounts in the future.

Straight-Line Depreciation

A technique for distributing the cost of an asset uniformly over its lifespan.

Q9: Which of the following defines Gross profit?<br>A)

Q76: Only temporary accounts appear on the post-closing

Q93: What is the result if the amount

Q98: <br>Please provide the journal entry on

Q104: Which of the following statements is an

Q106: A business pays $500 cash for supplies.Which

Q110: One hundred units of inventory on hand

Q114: A business purchases supplies for $200

Q134: An invoice in the amount of $600.00

Q151: An adjusted trial balance for Woods