Blum Services Has the Following Unadjusted Balances at Year-End The Following Information Is Available to Use in Making Adjusting

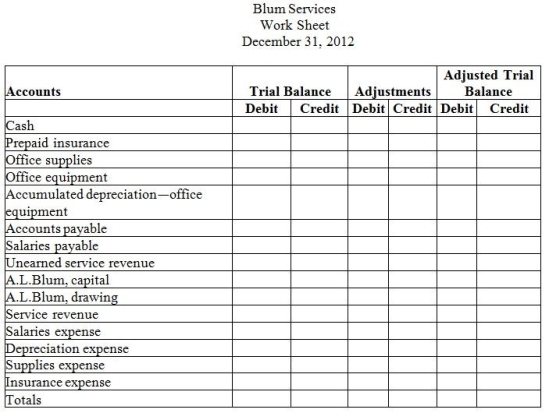

Blum Services has the following unadjusted balances at year-end.

The following information is available to use in making adjusting entries.

a.Office supplies on hand at year-end: $250

b.Prepaid insurance expired during the year: $325

c.Unearned revenue remaining at year-end: $2,500

d.Depreciation expense for the year: $1,800

e.Accrued salaries at year-end: $900

Using the work sheet below,prepare the trial balance,the adjustments and the adjusted trial balance for Blum Services.

Definitions:

Stereotype Threat

The risk of confirming negative stereotypes about an individual's racial, ethnic, gender, or cultural group, which can impact performance and behaviors.

High-School Drop-Out

An individual who has not completed high school or obtained a diploma.

SAT

A standardized test commonly used for college admissions in the United States, assessing a student's readiness for college.

General Education

A broad curriculum designed to give students a wide range of knowledge outside their major area of study.

Q4: The post-closing trial balance is an optional

Q10: What would the Cost of goods

Q37: Net sales revenue is equal to Sales

Q49: Everett paid transportation costs of $100.On

Q51: The general ledger shows a balance of

Q95: Everett paid transportation costs of $100

Q99: The accountant for Noble Jewelry Repair Services

Q103: Which of the following inventory costing methods

Q115: A business purchases equipment for cash in

Q160: A business pays salary expense of