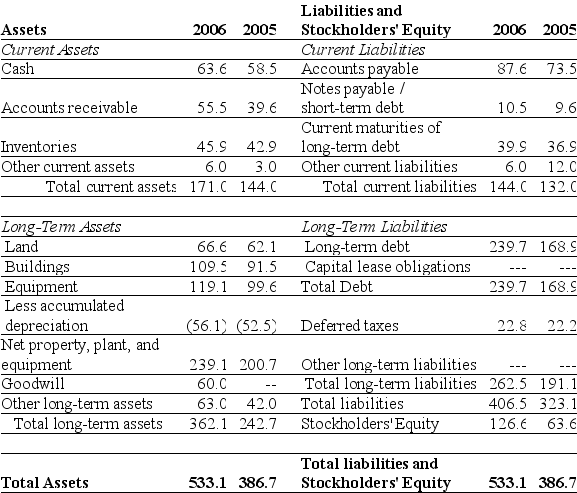

Use the table for the question(s) below.

-Refer to the balance sheet above.If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then Luther's market-to-book ratio would be closest to:

Definitions:

Time Periods

Specific intervals or spans of time during which certain events or measurements are taken or analyzed.

Indicator Variables

These are binary variables used in statistical models to represent the presence (with a value of 1) or absence (with a value of 0) of a particular condition or characteristic.

Seasonal Variations

Refers to fluctuations in data or activities that occur regularly based on seasonal changes throughout the year.

Trend Component

A component of time series data that represents the consistent, long-term direction of the data over time.

Q3: Assuming that Luther's bonds receive a AA

Q17: Consider an investment that pays $1000 certain

Q27: One way Enron manipulated its financial statements

Q27: A floor broker is a person at

Q27: A factory owner wants his workers to

Q42: Lucent receives the $3,000 on January

Q88: What is the present value (PV)of an

Q103: Diwali Airlines has a contract that gives

Q107: Treasury bonds have original maturities from one

Q151: In a trial balance,total debits are always