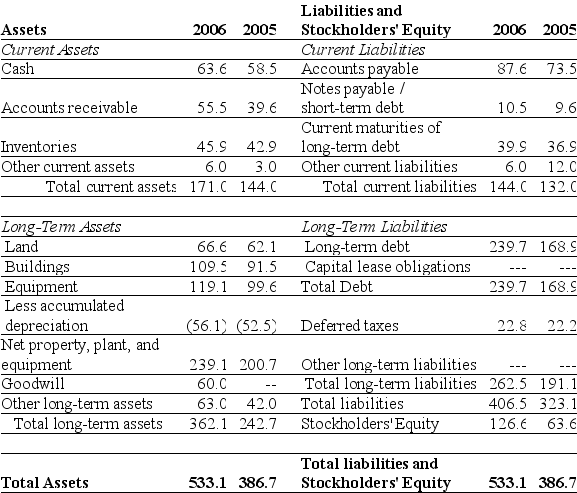

Use the table for the question(s) below.

-Refer to the balance sheet above.If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then using the market value of equity,the debt-equity ratio for Luther in 2006 is closest to:

Definitions:

U.S. Treasury

Refers to the federal government department responsible for managing government revenue and also to the securities (like bonds) it issues, considered low-risk investments.

Put Option

A financial contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying asset at a specified price within a specified time.

Underlying Asset

The financial asset upon which derivatives such as options and futures are based, determining their value.

Strike Price

The set price at which the holder of an options contract can buy (in a call option) or sell (in a put option) the underlying security or commodity.

Q4: The PCAOB is a watchdog agency that

Q10: Steve is offered an investment where for

Q14: Martin Supply Service paid $350 cash to

Q15: A proprietor may have to pay self-employment

Q72: The amount of your original loan is

Q74: What will be the effect on the

Q79: A $60,000 loan is taken out on

Q85: An owner invests $20,000 in her new

Q104: By looking at a statement of owner's

Q130: Sharon Samson starts a plumbing service named