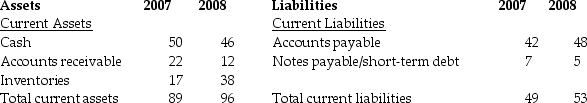

Use the table for the question(s) below.

Balance Sheet

Net property, plant,

Net property, plant,

-If the above balance sheet is for a retail company, what indications about this company would best be drawn from the changes in quick ratio between 2007 and 2008?

Definitions:

Total Revenue

Total revenue is the total amount of money earned by a firm from the sale of its goods and services before any costs are subtracted.

Demand Schedule

A table that lists the quantities of a good a consumer is willing to purchase at different price levels during a specific time period.

Total Revenues

The total amount of money generated from sales of products or services before any expenses are subtracted.

Price

The amount of money or its equivalent required to purchase a good, service, or asset, acting as a reflection of its value.

Q5: The above table shows the yields to

Q9: A bond is currently trading below par.Which

Q29: What is the combined effect on Owner's

Q38: Which of the following statements are true?<br>A)A

Q44: A McDonald's Big Mac value meal consists

Q65: In 2007,interest rates were about 4.5% and

Q85: In 2009,U.S.Treasury yielded 0.1%,while inflation was 2.7%.What

Q102: What is one of the prerequisite conditions

Q121: For Salary Payable,the category of account and

Q130: A business buys $500 of supplies on