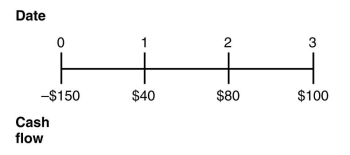

Consider the following timeline:

If the current market rate of interest is 12%,then the value of the cash flows in year 0 and year 2 as of year 1 is closest to:

Definitions:

Standard Deviation

A measure of the dispersion or spread of a set of numbers, indicating how much variation exists from the average.

Risky Asset

An investment that holds a degree of uncertainty regarding its returns or principal amount.

Non-Risky Asset

A financial asset with a guaranteed or highly predictable return rate, such as government bonds.

Expected Return

The anticipated gain or loss for an investment over a given period, often expressed as a percentage.

Q1: A janitorial services firm is considering two

Q23: An oil company is buying a semi-submersible

Q26: Which of the following formulas is INCORRECT?<br>A)g

Q55: Which of the following is true about

Q60: Jumbuck Exploration has a current stock price

Q68: Which of the following statements is FALSE?<br>A)One

Q71: Lindsey Smith decided to start her own

Q89: Net present value (NPV)is the difference between

Q105: The following show four mutually exclusive investments.Which

Q141: The assets and liabilities of Matt Wesley