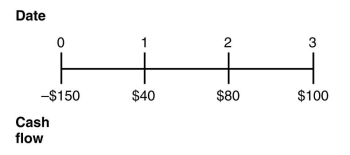

Consider the following timeline:

If the current market rate of interest is 12%,then the value of the cash flows in year 0 and year 2 as of year 1 is closest to:

Definitions:

Phenotypic Expression

Phenotypic expression is the observable physical and physiological traits of an organism resulting from the interaction of its genetic makeup with the environment.

Heterozygous

Having two different alleles for a particular gene, one inherited from each parent.

Allelic Form

Variations of a gene that occur in the same place on a chromosome.

Recessive Allele

An allele that produces its characteristic phenotype only when its paired allele is identical.

Q1: Which of the following organizations requires publicly

Q16: If the interest rate is 5%,the one-year

Q41: A five-year bond with a $1000 face

Q75: What is the shape of the yield

Q75: A ten-year,zero-coupon bond with a yield to

Q85: A car dealership offers a car for

Q96: Refer to the income statement above.Assuming that

Q113: A business renders services to its

Q144: The proprietor of Martin Supply Services took

Q145: Which of the following financial statements reports