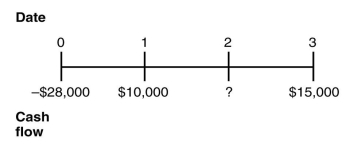

You are offered an investment opportunity that costs you $28,000,has a net present value (NPV) of $2278,lasts for three years,has interest rate of 10%,and produces the following cash flows:

The missing cash flow from year 2 is closest to:

Definitions:

Credit Sales

Sales made by a business where payment is not received at the time of sale but is instead deferred to a later date.

Raw Materials Purchases

The total cost incurred to buy raw materials that are to be used in the production process.

Raw Materials Inventory

The total cost of all components and materials stored that are eventually used in the manufacture of a product.

Master Budget

A comprehensive financial planning document that includes all of the organization's financial plans.

Q2: Corporate ownership is a very popular type

Q4: How does a firm select the dates

Q19: Refer to the income statement above.Luther's net

Q24: Consider the above Income Statement for Xenon

Q48: Which of the following reasons for considering

Q53: Assuming that this bond trades for $1035.44,then

Q79: To enable costs and benefits to be

Q104: What must be the price of a

Q110: You are considering adding a microbrewery onto

Q116: The internal rate of return (IRR)for this