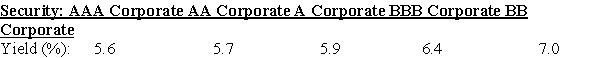

A mining company needs to raise $100 million in order to begin open pit mining of a coal seam.The company will fund this by issuing 30-year bonds with a face value of $1000 and a coupon rating of 6%,paid annually.The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings.If the mining company's bonds receive a A rating,what will be their selling price?

Definitions:

Total SS

The total sum of squares, which quantifies the total variation in a dataset by measuring the sum of the squared differences from the mean.

Two-way Analysis of Variance

A statistical technique that evaluates the impact of two categorical independent variables on a continuous dependent variable.

Background Music

Music that is played in the background of a setting or environment, not meant to be the focal point.

Assembly Methods

Techniques used in manufacturing, engineering, and software development to assemble components together to create a final product or system.

Q5: Suppose you invested $75 in the Ishares

Q6: The ownership in a corporation is divided

Q8: A metal fabrication company is pricing raw

Q9: A bond is currently trading below par.Which

Q12: Under what situation can the net present

Q38: Which of the following statements is FALSE?<br>A)A

Q40: What is the diversification achieved by an

Q92: Suppose you invested $60 in the Ishares

Q101: According to Graham and Harvey's 2001 survey

Q105: Historically,stocks have delivered a _ return on