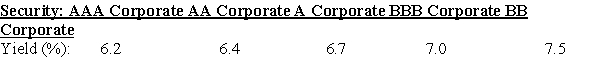

Consolidated Insurance wants to raise $35 million in order to build a new headquarters.The company will fund this by issuing 10-year bonds with a face value of $1,000 and a coupon rating of 6.5%,paid semiannually.The above table shows the yield to maturity for similar 10-year corporate bonds of different ratings.Which of the following is closest to how many more bonds Consolidated Insurance would have to sell to raise this money if their bonds received an A rating rather than an AA rating?

Definitions:

Independence

A concept in probability and statistics indicating that two events or variables have no association or influence on each other.

Categorical Variables

Variables that represent categories and can take on a limited, and usually fixed, number of possible values.

Degrees Of Freedom

The number of independent values or quantities which can be assigned to a statistical distribution or in the calculation of a statistic, typically in the context of parameter estimation.

Chi-Square Distribution

A statistical distribution used to describe the distribution of a sum of the squares of independent random variables.

Q3: What is the present value (PV)of an

Q5: In general,a successful firm will have a

Q22: Valorous Corporation will pay a dividend of

Q31: If money is invested at 8% per

Q32: Assuming that college costs continue to increase

Q36: How does a firm select the date

Q48: Which of the following bonds will be

Q54: Bubba Ho-Tep Company reported net income of

Q73: When looking at investment portfolios historically,was there

Q89: You are in the process of purchasing