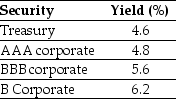

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The credit spread of the B corporate bond is closest to:

Definitions:

Gross Profits

Total revenue of a company minus the cost of goods sold.

Payoff Table

A tabular representation of the outcomes (payoffs) of different decisions under various states of nature.

Advertising Budget

The amount of money allocated towards promoting a product, service, or brand during a set period.

Sales Increase

A rise in the quantity or amount of products or services sold over a specific period.

Q21: Which of the following statements is FALSE?<br>A)Because

Q38: The depreciation tax shield for the Sisyphean

Q40: Which of the following is NOT considered

Q47: If you want to value a firm

Q60: Jim owns a farm that he wants

Q71: If a business owner is using the

Q75: You purchased Enron stock at a price

Q87: The third party who checks annual financial

Q88: The price (expressed as a percentage of

Q96: Most corporations measure the value of a