Use the information for the question(s) below.

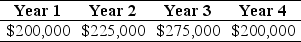

The Sisyphean Company is planning on investing in a new project.This will involve the purchase of some new machinery costing $450,000.The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.

-The internal rate of return (IRR) for this project is closest to:

Definitions:

Baboons

Refers to a variety of large, terrestrial monkeys native to Africa and Arabia, known for their size, strength, and social complexity.

Chimpanzees

A species of great ape native to Africa, known for their complex social behaviors and intelligence.

Gorillas

Large primates native to Africa, known for their social structure and intelligence, belonging to the species Gorilla, divided into two groups: the eastern and western gorillas.

Locomotion

The ability or act of moving from one place to another, utilized by living organisms to navigate through their environments.

Q2: Individual investors' tendency to trade too much

Q22: Which of the following is the appropriate

Q22: Valorous Corporation will pay a dividend of

Q32: Which of the following best explains why

Q50: Assume that you purchased Ford Motor Company

Q53: Which alternative offers you the lowest effective

Q79: Which of the following statements is FALSE?<br>A)We

Q82: What is the Net Present Value rule?

Q85: Why are the interest rates of U.S.Treasury

Q113: Should personal preferences for cash today versus