Use the table for the question(s) below.

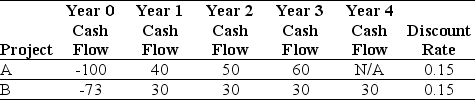

Consider the following two projects:

-The net present value (NPV) of project A is closest to:

Definitions:

Sole Proprietorship

A type of enterprise that is owned and run by one individual and in which there is no legal distinction between the owner and the business entity.

Company Formation

The legal process involved in starting a new corporation or business entity, including registration and obtaining necessary licenses and permits.

Limited Liability

The condition by which shareholders' responsibility for the company's debts and liabilities is limited to the amount they invested.

Ownership Transfer

The process of transferring the legal rights and titles of an asset or property from one entity or individual to another.

Q3: If a stock pays dividends at the

Q4: Sara wants to have $500,000 in her

Q17: Apple computers has raised all its capital

Q19: Which of the following is NOT a

Q21: Which of the following statements is FALSE?<br>A)Because

Q35: The real interest rate is the rate

Q66: A firm's sources of financing,which usually consists

Q68: Which of the following is the best

Q82: A consumer good company is developing a

Q107: In general,if an action increases a firm's