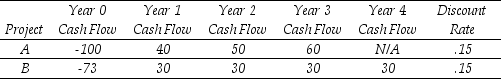

Use the table for the question(s) below.

Consider the following two projects with cash flows in $:

-The profitability index for project A is closest to:

Definitions:

Merger Plan

A strategic proposal for combining two or more companies into a single entity to achieve business benefits.

Pre-merger Market Values

The valuation of companies before they undergo a merger, factoring in stock prices, assets, and overall financial health.

Assets and Liabilities

Balance sheet components where assets are resources owned by a business, and liabilities are its financial obligations.

Holding Company

A corporation that owns enough voting stock in another company to control its policy and management.

Q2: Since your first birthday,your grandparents have been

Q41: The discounted free cash flow model ignores

Q43: The WACC does not depend on the

Q49: Which of the following statements is FALSE?<br>A)Many

Q53: Two mutually exclusive investment opportunities require an

Q57: How are interest and return of principal

Q68: The weight of Abbott Labs in your

Q70: A portfolio has three stocks - 300

Q106: A stationery company plans to launch a

Q112: A firm is considering several mutually exclusive