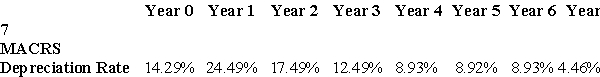

A textile company invests $12 million in an open-end spinning machine.This was depreciated using the seven-year MACRS schedule shown above.If the company sold it immediately after the end of year 3 for $7 million,what would be the after-tax cash flow from the sale of this asset,given a tax rate of 40%?

Definitions:

March On Washington

A significant event in 1963 where civil rights leaders and supporters gathered in Washington, D.C., advocating for civil and economic rights for African Americans.

Roe V. Wade

A landmark 1973 Supreme Court case that ruled the Constitution of the United States protects a pregnant woman's liberty to choose to have an abortion without excessive government restriction.

Peace Corps

A volunteer program run by the United States government aimed at providing social and economic development abroad through technical assistance, while promoting mutual understanding between Americans and populations served.

Freedom Summer

A 1964 campaign in the United States aimed at registering as many African American voters as possible in Mississippi, marked by significant activism and opposition.

Q5: The above table shows the yields to

Q9: Why should an investor invest in a

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" The timeline of

Q21: Diversification reduces the risk of a portfolio

Q29: Which of the following statements is FALSE?<br>A)The

Q54: Assuming that Luther's bonds receive a AA

Q61: What is the excess return for corporate

Q88: GM has a book value of $8

Q101: According to Graham and Harvey's 2001 survey

Q103: What is the general relationship between the