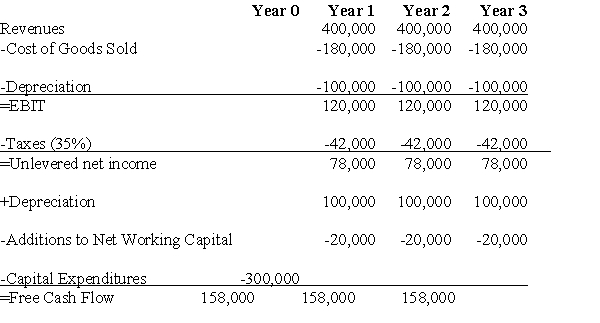

Use the table for the question(s) below.

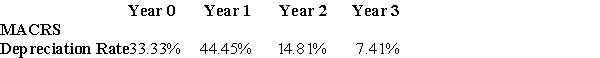

-Visby Rides,a livery car company,is considering buying some new luxury cars.After extensive research,they come up with the above estimates of free cash flow from this project.The depreciation schedule shown is for three-year,straight-line depreciation.By how much would the net present value (NPV) of this project be increased,if the cars were depreciated by the MACRS schedule shown below given that the cost of capital is 10%?

Definitions:

Callable Bond

A type of bond that gives the issuer the right to repay the bond before its maturity date, typically at a predefined call price.

Yield to Call

The interest rate that an investor would receive if they held a callable bond until the call date.

Quoted Coupon Rate

This is the annual interest rate paid by a bond, expressed as a percentage of the bond’s face value and fixed for the bond's lifespan.

Zero Coupon Bond

A bond that is issued at a discount to its face value and pays no interest but is redeemed at its face value at maturity.

Q2: Individual investors' tendency to trade too much

Q10: Sunnyfax Publishing pays out all its earnings

Q12: Under what situation can the net present

Q20: Which of the following bonds will be

Q52: The payback period for project A is

Q55: Which of the following best describes the

Q65: If WiseGuy Inc.uses IRR rule to choose

Q66: The effective annual rate on your firm's

Q71: If you build a large enough portfolio,you

Q76: Suppose you invested $56 in the Ishares