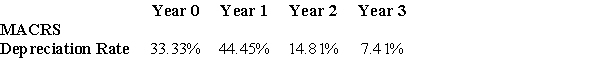

A machine is purchased for $500,000 and is used through the end of Year 2.The machine will be depreciated using the 3-Year MACRS schedule.At the end of Year 2,the machine is sold for $75,000.What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 40%?

Definitions:

Q8: Which of the following statements regarding exit

Q21: Which of the following statements is FALSE?<br>A)Because

Q36: When we combine stocks in a portfolio,the

Q37: Stocks with high returns are expected to

Q48: The Net Present Value rule implies that

Q49: Which of the following is true about

Q58: Which of the following statements is FALSE?<br>A)The

Q62: The effective annual rate (EAR)for a loan

Q69: What are project externalities?

Q95: CathFoods will release a new range of