Use the information for the question(s) below.

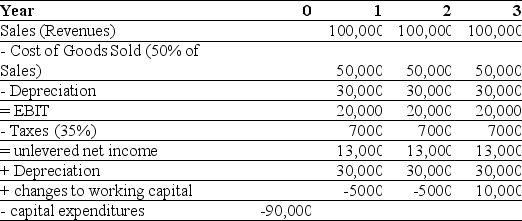

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projects:

-The net present value (NPV) for Epiphany's Project is closest to:

Definitions:

Interest Rate

The percentage of a loan charged to the borrower as interest, usually represented as an annual percentage rate of the remaining loan balance.

Market For Foreign-Currency Exchange

A marketplace where participants can trade currencies from different countries, essentially a repeated framework for the process in

Real Exchange Rate

The price of one country's currency in terms of another currency, adjusted for inflation, which reflects the purchasing power between the two countries.

Surplus

The situation in which the quantity of a good or service supplied is more than the quantity demanded.

Q22: Why do we use leverage if it

Q38: A firm has a capital structure with

Q50: Assume the appropriate discount rate for this

Q55: Which of the following best describes the

Q55: A truck costing $112,000 is paid off

Q59: A Xerox DocuColor photocopier costing $42,000 is

Q73: A portfolio has three stocks - 200

Q74: If the yield to maturity of all

Q101: The market value of Fords' equity,preferred stock

Q111: Consider the following list of projects:<br> <img