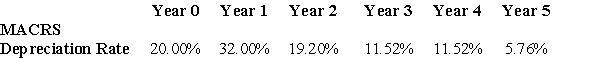

A bakery invests $30,000 in a light delivery truck.This was depreciated using the five-year MACRS schedule shown above.If the company sold it immediately after the end of year 2 for $22,000,what would be the after-tax cash flow from the sale of this asset,given a tax rate of 40%?

Definitions:

Autonomous Father

Refers to a father who independently makes parenting decisions and carries out parental responsibilities without relying extensively on others.

Constantly Traveled

Frequently moving from place to place without a permanent residence or spending a significant amount of time in transit.

Innately More Nurturing

The notion that certain individuals are naturally more inclined to provide care and support to others.

Child Care Activities

Tasks and responsibilities associated with the care and upbringing of children, including education, nurturing, and ensuring their health and safety.

Q14: What is the assumption about risk when

Q26: An investor is considering the two investments

Q31: Valuation models use the relationship between share

Q32: As part of the registration statement ,the

Q41: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" A textile company

Q45: Your estimate of the market risk premium

Q46: Assume that your capital is constrained,so that

Q76: Tanner is choosing between two investment options.He

Q87: A manufacturer of video games develops a

Q106: What is the net present value (NPV)of