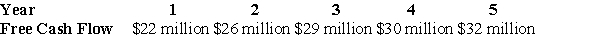

General Industries is expected to generate the above free cash flows over the next five years,after which free cash flows are expected to grow at a rate of 3% per year.If the weighted average cost of capital is 8% and General Industries has cash of $10 million,debt of $40 million,and 80 million shares outstanding,what is General Industries' expected current share price?

Definitions:

Style of Reaction

The individual manner in which a person responds to stimuli or situations, often linked to temperament or personality.

Inherent Responding

The natural or instinctive reactions and responses that are built-in or innate to an organism, not learned through experience.

Difficult Temperament

A behavioral profile observed in infants and children characterized by high levels of irritability, difficulty adjusting to new situations, and irregular bodily functions.

Irregular Sleep

A pattern of sleeping where the timing, duration, or quality of sleep varies significantly and inconsistently night to night.

Q8: A stock market comprises 2000 shares of

Q19: The market value of Fords' equity,preferred stock,and

Q31: A firm issues ten-year bonds with a

Q33: A stock whose return does not depend

Q41: Preferred stock of Ford Motors pays a

Q65: What is the expected payoff for Big

Q67: Which of the following factors that a

Q69: A firm has a pre-tax cost of

Q74: The volatility of your investment is closest

Q108: The standard deviation for the return on