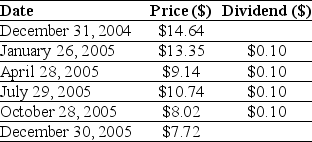

Use the table for the question(s) below.

Consider the following price and dividend data for Ford Motor Company:

-Assume that you purchased Ford Motor Company stock at the closing price on December 31,2004 and sold it at the closing price on December 30,2005.Your realized annual return is for the year 2005 is closest to:

Definitions:

Knowledge

Information, understanding, and skills that individuals acquire through experience or education.

Goal Setting

Determining goals that are clear, quantifiable, feasible, pertinent, and have a defined timeline.

Relevant Goals

Objectives that are pertinent and directly relate to the desired outcome or mission of an individual or organization.

Goal Commitment

The determination and persistence of an individual or group to achieve a set of objectives or targets.

Q12: A company issues a callable (at par)20-year,5%

Q13: Which of the following statements is FALSE?<br>A)When

Q49: A garage is comparing the cost of

Q51: Assuming the appropriate YTM on the Sisyphean

Q58: Which of the following best describes a

Q69: Which of the following equations is INCORRECT?<br>A)x<sub>i</sub>

Q73: A portfolio has three stocks - 200

Q99: If the appropriate discount rate for this

Q102: After the venture capitalist's investment,what percentage of

Q110: Shown above is information from FINRA regarding