Use the table for the question(s) below.

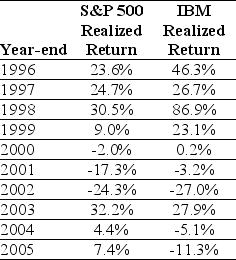

Consider the following realized annual returns:

-The average annual return over the period 1926-2009 for the S&P 500 is 11.7%,and the standard deviation of returns is 20.5%.Based on these numbers,what is a 95% confidence interval for 2010 returns?

Definitions:

High Relationship Behavior

Leadership behavior focused on creating positive relationships, involving support, encouragement, and communication with team members.

Inspirational Motivation

The ability to inspire and motivate others towards achieving shared goals or visions through positive reinforcement, enthusiasm, and emotional appeal.

Articulate A Vision

The ability to clearly express a compelling future state or goal that motivates and guides others.

Appealing

Having an attractive or interesting quality that draws attention or desire.

Q2: Independent risk is more closely related to:<br>A)unsystematic

Q22: Financial managers prefer to choose the same

Q28: Which of the following is NOT a

Q32: Which of the following statements is FALSE?<br>A)The

Q36: A capital budget lists the potential projects

Q50: Why do most people launching a start-up

Q56: When different investment rules give conflicting answers,then

Q58: Chittenden Enterprises has 632 million shares outstanding.It

Q59: A mining company plans to mine a

Q95: Stocks have both diversifiable risk and undiversifiable