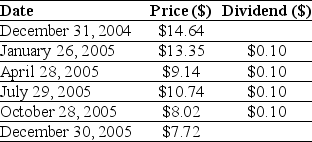

Use the table for the question(s) below.

Consider the following price and dividend data for Ford Motor Company:

-Assume that you purchased Ford Motor Company stock at the closing price on December 31,2004 and sold it after the dividend had been paid at the closing price on January 26,2005.Your capital gains rate (yield) for this period is closest to:

Definitions:

Annual Rate of Return

The percentage return on an investment over a one-year period, encompassing both capital gains and interest payments.

Expected Annual Net Income

The projection of a company's net income over a year, taking into account estimated revenues and expenses.

Average Investment

The middle amount invested over a period of time, often used in performance measurement or investment appraisal.

Unprofitable Segment

A division or part of a business that consistently operates at a loss, detracting from the overall profitability of the company.

Q15: A firm has $2 million market value

Q33: A "round lot" consists of how many

Q34: The Valuation Principle states that the value

Q35: The _ of a firm's debt can

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" A corporation issues

Q67: Among the two models Constant Dividend Growth

Q74: Which of the following is an activity

Q76: A small manufacturer that makes clothespins and

Q95: Equity investors in a private company usually

Q100: The average annual return on IBM from