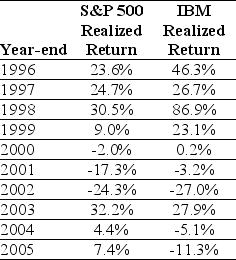

Use the table for the question(s) below.

Consider the following realized annual returns:

-The average annual return over the period 1926-2009 for the S&P 500 is 11.7%,and the standard deviation of returns is 20.5%.Based on these numbers,what is a 67% confidence interval for 2010 returns?

Definitions:

Collusion

An agreement between competing firms to control prices or exclude entry of a new competitor in the market, often in secret, to reduce competition and increase profitability.

Cutthroat Competition

An intense form of competition in a market where competitors aggressively undercut each other's prices or use other aggressive tactics to gain market share.

Concentration Ratios

Measures that indicate the extent to which a small number of firms dominate an industry or market.

Concentration Ratio

A measure used to denote the market share or dominance of the largest firms within an industry, indicating the level of competition.

Q8: What are the implications of the efficient

Q15: Consider a zero-coupon bond with $1,000 face

Q18: Which of the following investments offered the

Q24: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" Conundrum Mining is

Q31: The owner of a hair salon spends

Q40: Jenkins Security has learned that a rival

Q46: Luther Industries currently has 100 million shares

Q51: The Ontario Teacher's Pension Plan is a

Q59: A bond has a face value of

Q92: The net present value (NPV)for this project