Use the table for the question(s) below.

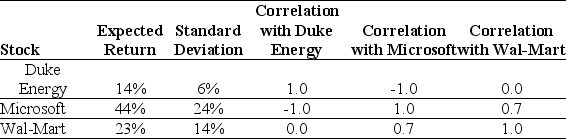

Consider the following expected returns,volatilities,and correlations:

-The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to:

Definitions:

Firm-Specific

Refers to risk or information that is unique to a particular company and not related to the market or industry.

Covariance

A measure used to determine how two variables change together, indicating the direction of the relationship.

Variance

A statistical measurement of the dispersion of data points in a data set around the mean, indicating the extent to which the numbers differ from each other.

Correlation Coefficient

A statistical measure that determines the degree to which two variables move in relation to each other, where +1 indicates a perfect positive correlation and -1 indicates a perfect negative correlation.

Q10: A stock market comprises 5000 shares of

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" The timeline of

Q15: Which of the following do firms consider

Q30: Which of the following adjustments should NOT

Q35: If your new strip mall will have

Q66: A firm's sources of financing,which usually consists

Q69: Which of the following equations is INCORRECT?<br>A)x<sub>i</sub>

Q71: If you build a large enough portfolio,you

Q105: When a firm offers to buy its

Q108: An all-equity firm produced a dividend flow