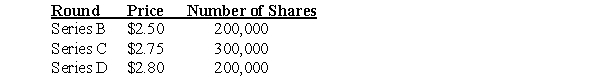

The founder of a company issues 100,000 shares of series A stock for his own $250,000 investment.He then goes through three further rounds of investment,as shown below:

What is the post-money valuation for the series-D funding round?

Definitions:

Convexity

A measure of the curvature in the relationship between bond prices and bond yields, indicating how the duration of a bond changes as the interest rate changes.

Zero-Coupon Bonds

Debt securities that are issued at a discount and redeemed at face value but do not pay interest during their lifetime.

Immunize

A strategy in finance to shield a portfolio from interest rate movements by aligning the duration of assets and liabilities, thus stabilizing its overall value.

Interest Rate Risk

The potential for investment losses caused by fluctuations in interest rates, affecting debt securities inversely with their prices.

Q2: Cameron Industries is purchasing a new chemical

Q4: A bond with a face value of

Q69: Which of the following equations is INCORRECT?<br>A)x<sub>i</sub>

Q69: What are project externalities?

Q78: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" A firm issues

Q86: A firm has $400 million of assets

Q95: CathFoods will release a new range of

Q97: A firm has interest expense of $2500

Q103: What are venture capital firms?

Q105: When a firm offers to buy its