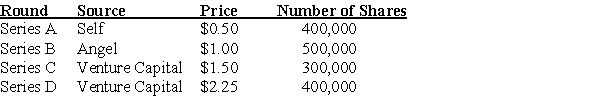

David found a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.What will be the IPO price per share?

Definitions:

Vietnamization

A policy of the Richard Nixon administration during the Vietnam War to end U.S. involvement in the war by expanding, equipping, and training South Vietnamese forces to take over combat roles.

South Vietnamese Troops

Armed forces of the Republic of Vietnam (South Vietnam), which fought against the North Vietnamese Army and Viet Cong during the Vietnam War.

San Antonio Independent School District V. Rodriguez

A landmark Supreme Court case in 1973, which ruled that disparities in school funding based on local property taxes do not violate the Equal Protection Clause of the Fourteenth Amendment.

Milliken V. Bradley

A significant Supreme Court case in 1974 that ruled against a proposed plan to bus students across district lines to desegregate schools, essentially reinforcing suburban school segregation.

Q33: The optimal capital structure depends on _

Q44: The use of leverage as a way

Q53: Which of the following is a notable

Q74: Ford Motors expects a new hybrid-engine project

Q77: What is the free cash flow to

Q80: A financial manager makes a choice of

Q84: If you build a large enough portfolio,you

Q92: What are the different ways a firm

Q96: The risk premium of a stock is

Q109: Rational investors _ fluctuations in the value