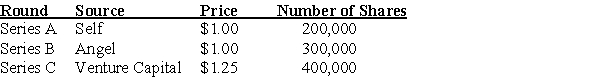

The founders and owners of a private company have funded it through the following rounds of investment:

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.What will be the IPO price per share?

Definitions:

Short-Run Losses

Financial deficits experienced by a business or project within a brief period, often due to initial start-up costs or market fluctuations.

Average Variable Costs

Costs that vary with output level, calculated by dividing total variable costs by the quantity of output produced.

Operate

To function or work in a particular manner, often referring to businesses and machinery performing their intended duties.

Diseconomies of Scale

The phenomenon where production costs per unit increase as the scale of operation expands.

Q7: If a firm is planning an expansion

Q7: Which of the following investments had the

Q10: Prada has ten million shares outstanding,generates free

Q12: Which of the following statements is FALSE?<br>A)The

Q30: LG Inc.has done a long-term forecast of

Q40: Jeremy founded a company.He issues 200,000 shares

Q62: If asset A's return is exactly two

Q75: You purchased Enron stock at a price

Q87: A firm is considering acquiring a competitor.The

Q105: Even if two firms operate in the