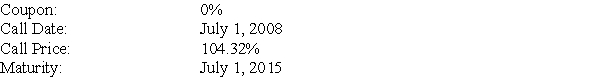

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $28.20.What is the minimum conversion ratio that would make a bondholder prefer to convert rather than accept the call price?

Definitions:

Depreciation Method

A systematic approach for allocating the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Residual Value

The estimated value that an asset will have at the end of its useful life, often considered for depreciation calculations.

Q23: Time Warner shares have a market capitalization

Q35: Firms can change dividends at any time,and

Q39: Which of the following statements regarding sinking

Q48: As we add more uncorrelated stocks to

Q56: A firm requires an investment of $20,000

Q60: Building a model for long-term forecasting reveals

Q64: The expected return on your of your

Q82: The standard deviation for the return on

Q86: A firm has $400 million of assets

Q93: The volatility on Home Depot's returns is