Use the information for the question(s) below.

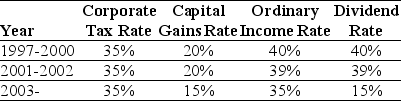

Consider the following tax rates:

*The current tax rates are set to expire in 2010 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire in 2010 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-In 2006,Luther Incorporated paid a special dividend of $5 per share for the 100 million shares outstanding.If Luther has instead retained that cash permanently and invested it into Treasury bills earning 6%,then the present value (PV) of the additional taxes paid by Luther would be closest to:

Definitions:

Germinal Center

A region within lymph nodes where mature B cells proliferate, differentiate, and mutate their antibody genes during an immune response.

Efferent Vessel

An efferent vessel is a lymphatic or blood vessel that carries fluid away from an organ or tissue, opposite to an afferent vessel which brings fluid to it.

Afferent Vessel

A vessel that carries blood or lymph fluid towards a particular tissue or organ in the body.

Lymphoid Organ

Lymphoid organs, including the lymph nodes, spleen, and thymus, are part of the immune system and play a role in producing, storing, and carrying white blood cells.

Q8: A firm has $50 million in equity

Q13: Assume that Omicron uses the entire $50

Q32: Using the percent of sales method,and assuming

Q41: When investors use leverage in their own

Q45: Firms may retain large amounts of cash

Q45: What is the general long run performance

Q64: Compute the after-tax interest expense for a

Q67: The E in the equation above represents<br>A)the

Q93: A call option gives the owner the

Q110: The level of cash a firm holds